Table of Content

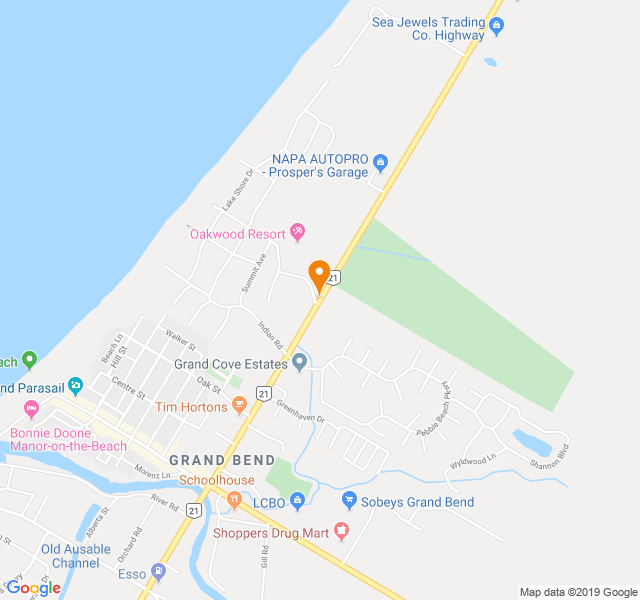

We can help design life and disability insurance coverage to protect the value of your business, retain key employees and provide deferred compensation. As residents of South Carolina, you’re faced with numerous life-threatening risks. To get online quotes on your home and compare rates on home insurance premiums in Hilton Head Island, enter your zip code above and easily complete our online quoting application. Remember, it's important to speak with us about additional home insurance discounts so you can get the best rate for your home in Beaufort County.

SuperPagesSM - helps you find the right local businesses to meet your specific needs. SuperPages advertisers receive higher placement in the default ordering of search results and may appear in sponsored listings on the top, side, or bottom of the search results page. Very few people that get Hilton Head Island homeowners insurance actually end up finding the best rates available. They will typically go with what their current insurance provider has for them, usually bundling that in order to get a discount. However, you can find several different South Carolina companies that will charge far less than what your existing insurance policy actually offers. In fact, they may even give you more coverage for less money, but you have to obtain home insurance quotes on the web that can lead you to these exceptional deals.

William P Dadio Jr: Allstate Insurance

This website may include content provided by third parties, including materials provided by other users, third-party licensors, syndicators, aggregators, and/or reporting services. These materials do not necessarily reflect the opinions or beliefs of Correll or any of its employees. Correll Insurance Group of Hilton Head has been meeting the insurance needs of individuals and businesses in the Lowcountry of South Carolina since 1984. We invite you to find out how our unique, personal agency culture sets us apart from other insurance agencies. Home insurance in Hilton Head Island covers an assortment of things relating to you and your property.

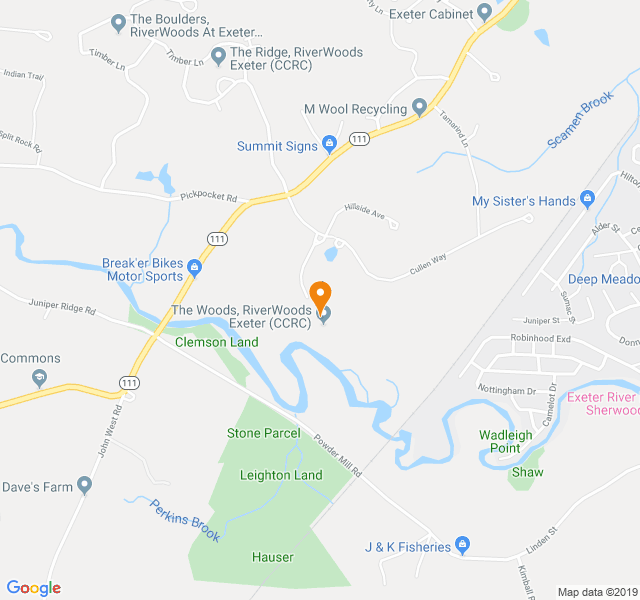

He is a graduate of Bluffton High School and Clemson University. When he is not working, he loves to spend his free time hunting and fishing. He started working for Hilton Head Insurance & Brokerage in January, 2017. You want to protect your loved ones after your gone – that’s possible with Kinghorn Insurance Agency’s Life Insurance policies. When it comes to home insurance, South Carolina homeowners have learned to trust us here at Kinghorn Insurance Agency of Hilton Head Island. Seacoast Insurance has been insuring the families and businesses of Hilton Head, Bluffton and the South Carolina Low Country since 1981.

Kevin Sevier - State Farm Insurance Agent

Jeff, one of the people responsible for the smooth operation of this company can sure take a load off everyone’s mind. This should be on everyone’s short list when it comes to anything insurance related. Hilton Head Island, SC homeowners insurance is nearly $820 to $1,124, about $68-$93/month. Our all inclusive guide reveals consumers can save upto $389 by getting multiple quotes. Enter your zipcode below and click “GO” to get multiple free quotes.

One of the most important insurance coverage you can seek is Life Insurance. Understand the common types of auto coverage and get the insurance you want, to fit your budget. Maybe you moved out but haven’t sold the property yet, or maybe it’s under renovation. Whatever the cause, Kinghorn Insurance Agency understands and has coverage options for you. One of the most important insurance coverage you can seek is Health Insurance.

Premier Insurance Advisors

I think the deductible is standard, and was set by me as usually the person paying for the insurance has that option. Boats, Motorcycles, Travel Trailers, Golf Carts, Renters, and Special Event Insurance. Your home is the center of your daily life, and likely your most valuable asset. Shows Hilton Head Island's lowest average rates with discounts applied. William is the newest member of our team with a long history of customer service in the retail industry as a general manager for Under Armour, Michael Kors, and Old Navy. William and his wife Joy have 3 children and love the beach, Disney, and running.

We work with quality insurance companies and employ dedicated insurance professionals. We’re committed to providing quality insurance services, and building long term relationships with our clients. The right auto insurance policy can help get you back on the road quickly if your car is damaged or totaled by a car accident, theft, or other event. We are a full service, Independent Insurance Agency that has served the Lowcountry and beyond. As a discerning, family owned agency, we have partnered with the most respected insurance companies in the industry. Whether it’s personal or business, we have the experience and the resources to tailor an insurance program to fit your individual needs.

We provide the RIGHT auto insurance that will help you get back on the road quickly if your car is damaged or destroyed. The homes with the highest rates per coverage amount, are usually the homes built in late 80’s or early 90’s with the original roof. Companies, now more than ever, are basing a higher percentage of the rate on the age of the roof. Most companies will not even consider insuring a home if the roof age is over years. For the homes that have roofs 20+ years old, the number of available companies is reduced from 50+ to less than five.

I pay comparable to my last home insurance and have more coverage than I previously had. However, the price does seem to increase by close to 10% each year, which is worrisome. I would find that the premium is a little bit higher than most other companies.

Coastal property insurance covers the unique needs of homes in the Lowcountry, including flood insurance, high-value homeowners’ insurance, and vacation home insurance. We stay up-to-date on changing laws and rates for coastal properties to help you find the most comprehensive yet affordable insurance plan for your home in Hilton Head or Bluffton. A local independent insurance agent can help you be certain that all of your residential properties are properly covered by competitively priced policies. All of our policies include Wind/Hurricane coverage (There is no need to have a separate wind/hail policy in South Carolina). In addition, all three came to our agency after saving an average of $2,200 per year at other agencies.

Ana Grace recently moved to the Bluffton area after growing up in Orlando, FL. She graduated from Valdosta State University in May of 2021 then came to join our company shortly after graduating. She is very excited to start her career in insurance and getting to know the area with her newlywed husband, Connor and their 2 dogs, Otis and Willow. Renee was born and raised outside of Washington, DC in Montgomery County Maryland and moved to Hilton Head in 2013. She has been an Account Manager for personal lines insurance for 7 years in Hilton Head. Renee and her husband Mike have 3 grown children and love the beach, traveling and boating. Diana Rideout went above and beyond for me on a recent auto claim.

Set up a stability technique in your home that is monitored by a central monitoring station, and you will save about 5 % on your home insurance policies. You will very likely have to provide evidence to your home insurance coverage business to get the price reduction, but that is as simple as sending them a duplicate of your monitoring bill. We tailor high-net-worth insurance policies to fit the unique needs of our clients. When you own a house that is not used as your primary residence, there are often additional risk factors that insurance companies will take into consideration. In some cases, you may be required to purchase specialized home insurance coverage.

We strive to stay up to date on the latest in the insurance industry, but we like to keep our clients up to date on info that can better help them and offer guidance. Living near the ocean is a wonderful luxury that many do not get to experience, finding quality boat insurance is a must. I wish my premiums were lower, but I feel the premiums are fair. I would definitely recommend Allstate to anyone looking for reasonable and trustworthy home owners insurance. Actually, I believe I have recommended Allstate since my claim roughly two years ago.

Kinghorn Insurance Agency

So you don’t have to choose between having a personal relationship with your agent and knowing they have access to world renowned markets. The burglary rate in South Carolina is higher than the national rate, but in Hilton Head, the rate is lower. That’s great news for area homeowners who are looking for affordable home insurance coverage. It’s responsible for protecting structures on your property that aren’t connected to your house, such as a shed, carport, detached garage and even fencing. It’s important to note these numbers are direct representations submitted by insurers to the department of insurance. For an example rate for higher-value homes, you can multiply the property value.